If you’re diving into the world of cryptocurrency trading, chances are you’ve heard about the power of a trading bot Binance. These automated software tools can execute trades 24/7, taking advantage of market opportunities without human fatigue or emotional bias. But how do you make sure you get the most from these bots? In this article, we’ll explore detailed tips, actionable strategies, and key considerations to maximize your trading bot experience on Binance.

The term trading bot Binance refers to programs specifically designed to interact with Binance’s API to automate buying and selling cryptocurrencies according to predefined algorithms. As one of the world’s largest crypto exchanges, Binance offers a robust infrastructure that supports advanced automated trading, making it a popular choice for bot users globally.

What Is a Trading Bot Binance and How Does It Work?

A trading bot Binance is software that uses Binance’s API to perform trades on your behalf. Instead of manually checking prices and executing orders, the bot continuously monitors market conditions, analyzes data, and places trades based on the strategy you program or select. This automation reduces the time spent staring at charts and helps execute orders faster than any human could.

There are different types of bots: some focus on arbitrage (exploiting price differences across exchanges), others on market making (providing liquidity), while many use technical indicators like RSI or MACD to decide when to buy or sell. Selecting the right bot depends on your risk tolerance, capital, and trading goals.

Choosing the Best Trading Bot Binance for Your Needs

With countless bots available, selecting the right trading bot Binance can feel overwhelming. Here are some criteria to help you decide:

- Security: Ensure the bot does not have withdrawal rights and uses encrypted API keys.

- Reputation: Look for reviews, user testimonials, and community feedback.

- Customization: Can you set your own strategies or parameters?

- Ease of Use: Does the bot have an intuitive interface?

- Support and Updates: Check if the developer provides regular updates and responsive support.

- Backtesting Feature: Ability to test your strategies against historical data.

Popular platforms include 3Commas, Cryptohopper, and Binance’s own Binance Futures API integration. Research and trial different options to find what suits you best.

Setting Up Your Trading Bot Binance Safely

After choosing your bot, the next step is secure setup:

- Generate Binance API Keys: From your Binance account, create API keys with trading permission enabled but disable withdrawal rights.

- Use IP Whitelisting: Restrict API key usage to your trusted IP addresses.

- Enable Two-Factor Authentication: Secure your Binance and bot accounts with 2FA.

- Start with Small Capital: Begin trading with small amounts to minimize risks while testing.

- Monitor Activity: Keep an eye on trades and API activity for any unusual behavior.

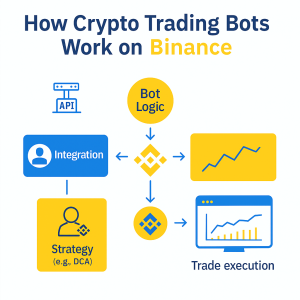

Understanding Binance API and Its Role in Trading Bots

One of the critical components that make a trading bot Binance work effectively is the Binance API (Application Programming Interface). The API serves as a bridge between your bot software and Binance’s trading platform, allowing the bot to send and receive data securely. This connection enables the bot to check real-time market prices, place buy and sell orders, and monitor your account balance without manual intervention.

Binance provides detailed API documentation that developers use to create bots. For users, understanding how to generate API keys on Binance is crucial. You can create keys with customized permissions: usually, you grant trading access but not withdrawal rights. This limitation protects your funds in case the bot or API keys are compromised.

Furthermore, Binance API has rate limits to prevent abuse, meaning your bot must operate within certain request thresholds to avoid being temporarily blocked. Choosing a bot that respects these limits is vital to maintaining uninterrupted service.

Common Mistakes to Avoid When Using a Trading Bot Binance

While trading bots offer many benefits, beginners often fall into avoidable pitfalls that harm their results or compromise security. Here are some common mistakes to watch out for:

- Overtrusting the Bot: Never let your bot run unchecked for long periods. Regular monitoring is essential to ensure it behaves as expected, especially during volatile market phases.

- Ignoring Market Conditions: Bots follow predefined rules but don’t adapt intuitively like humans. When markets crash or surge unexpectedly, manual intervention might be needed to pause or adjust the bot.

- Using Bots Without Testing: Deploying a bot live without backtesting or paper trading is risky. Always simulate your strategy with historical data or demo accounts before committing real funds.

- Setting Unrealistic Expectations: Bots automate trades but don’t guarantee profits. Avoid chasing quick gains and remember that losses are part of trading.

- Granting Excessive Permissions: Avoid giving your bot withdrawal access on Binance. This is unnecessary and exposes you to hacking risks.

How to Backtest Your Trading Bot Strategies Effectively

Backtesting is a crucial step to ensure your chosen strategy works well with your trading bot Binance. It involves running your trading algorithm on historical market data to analyze how it would have performed in the past. Here are steps to do this effectively:

- Obtain Accurate Historical Data: Use Binance’s official data or trusted third-party providers to get reliable price charts.

- Define Clear Parameters: Set your entry, exit, stop-loss, and take-profit levels precisely.

- Run Simulations: Use your bot or specialized backtesting software to simulate trades over selected time frames.

- Analyze Results: Look at profitability, drawdowns, win rates, and trade frequency to evaluate viability.

- Optimize Settings: Tweak your parameters and rerun tests to improve performance without overfitting.

Backtesting doesn’t guarantee future results but helps you avoid costly errors and refine your approach before deploying your bot live on Binance.

Integrating Risk Management in Your Trading Bot Setup

Risk management is an essential pillar of successful trading, and this applies equally when using a trading bot Binance. Here are practical tips to incorporate risk controls:

- Set Stop-Loss Orders: Automate exits to limit losses if a trade moves against you.

- Use Position Sizing: Avoid risking too much capital on a single trade; many traders risk 1-2% per trade.

- Diversify Strategies: Don’t rely on just one trading approach; combine several strategies to spread risk.

- Adjust for Market Volatility: Increase caution during high volatility by lowering trade size or tightening stop-losses.

- Keep Some Funds in Reserve: Don’t allocate your entire capital to bots; maintain liquidity for emergencies.

By integrating these risk measures, you protect your portfolio and increase the chance of sustainable profits with your Binance trading bot.

Advanced Features and Customization Options for Experienced Traders

For traders who want to go beyond basic setups, many trading bot Binance platforms offer advanced features such as:

- Trailing Stop Loss: Automatically adjusts the stop loss level as the price moves favorably, locking in profits;

- Multiple Exchange Support: Manage accounts and trades across Binance and other exchanges in one interface;

- Technical Indicators Integration: Use RSI, MACD, Bollinger Bands, and others to refine entry/exit signals;

- API for Custom Coding: For developers, open APIs allow building fully custom bots tailored to unique strategies;

- Social Trading and Copybots: Follow or copy strategies from successful traders automatically;

- Multi-Asset Portfolio Management: Automate trading across various coins, balancing risk and exposure.

Exploring these capabilities requires deeper knowledge but can significantly enhance your trading outcomes when used wisely.

Staying Updated with Binance and Market Changes

The cryptocurrency ecosystem evolves rapidly. Binance regularly updates its API, trading rules, and platform features, which can affect your trading bot Binance performance. To stay ahead:

- Subscribe to Binance Announcements: Follow official Binance channels for API updates and maintenance schedules;

- Join Bot Communities: Participate in forums, Telegram groups, or Reddit communities for tips and shared experiences;

- Update Your Bot Software Regularly: Ensure your bot has the latest patches to maintain compatibility and security;

- Follow Crypto News: Economic events and regulatory changes impact markets, influencing bot strategies;

- Review Your Strategies Frequently: Adjust your bot’s parameters in response to new market dynamics.

Being proactive will help you avoid unexpected downtime or losses caused by outdated bot configurations.

How to Combine Manual and Automated Trading on Binance

While trading bot Binance software can handle many tasks, some traders prefer a hybrid approach that mixes automation with manual oversight. This balance allows you to benefit from automation’s speed and consistency while applying human judgment in complex situations.

Here’s how to combine both effectively:

- Set Clear Boundaries: Define which tasks the bot handles (e.g., grid trading) and which require manual input (e.g., news-based decisions);

- Use Alerts: Configure your bot to send notifications for significant market events or trade executions;

- Monitor Regularly: Check your bot’s performance daily or weekly and intervene if needed;

- Keep Learning: Continuously analyze trade results and update your manual strategies alongside bot settings;

- Maintain Flexibility: Pause or stop the bot during unusual market conditions to avoid unexpected losses.

This integrated approach can optimize your Binance trading experience by combining the best of automation and human insight.

Building Your Own Trading Bot: An Overview for Developers

If you have programming skills, building a custom trading bot Binance might be an exciting project. This gives you full control over the logic, strategies, and features tailored precisely to your needs.

Key steps include:

- Learn Binance API: Understand the endpoints, authentication, and rate limits;

- Choose a Programming Language: Python, JavaScript, and Java are popular choices due to available libraries;

- Implement Core Functions: Account balance checks, order placement, order status monitoring;

- Integrate Trading Logic: Program your strategies using technical indicators or price patterns;

- Test Extensively: Use sandbox environments or paper trading to debug and optimize;

- Deploy Securely: Use secure servers, encrypted API keys, and monitor the bot’s activity;

- Keep Improving: Adapt your bot to market changes and new trading ideas continuously.

Building your own bot is rewarding but requires significant effort and understanding of both programming and trading principles.

Useful Resources to Deepen Your Knowledge on Trading Bot Binance

To further enhance your skills, consider exploring these resources:

- Binance API Documentation – Official guide to Binance’s API;

- TradingView – Platform for charting and strategy backtesting;

- Reddit Binance Community – Discussions on trading and bots;

- CryptoCompare – Crypto market data and analysis;

- Investopedia on Algorithmic Trading – Fundamental concepts explained;

- GitHub Binance API Examples – Code samples and libraries.

Leveraging these materials will help you become a more confident and skilled user of trading bot Binance systems.

Conclusion: Making the Most of Trading Bot Binance

Automating your trades with a trading bot Binance can be a game-changer, but it requires a balanced approach of knowledge, caution, and active management. By understanding how bots interact with Binance’s API, choosing trusted platforms, applying sound strategies, and prioritizing security, you set yourself up for better chances of success.

Remember, no bot replaces the need for continuous learning and adaptation. Keep testing, tweaking, and engaging with the crypto community to stay informed. With time and patience, your trading bot can become a powerful tool in your investment arsenal.

What challenges have you faced with trading bots on Binance? Do you have tips or favorite strategies to share? Join the conversation in the comments below!

FAQ

- What is a trading bot Binance?

A software program that uses Binance’s API to automate cryptocurrency trades based on predefined rules. - Are trading bots safe to use on Binance?

Yes, if you use reputable bots, disable withdrawal permissions, and follow security best practices. - Do trading bots guarantee profits?

No, bots automate trading but cannot guarantee profits; they also carry risks. - Can I build my own trading bot for Binance?

Yes, Binance provides API documentation and tools for developers to create custom bots. - How do I backtest my trading bot strategy?

By running your strategy against historical price data to evaluate its past performance before live deployment.

Leave a Reply